Executive overview

Introduction

- Identify regional betting preferences

- Track emerging trends

- Connect activity to cultural or seasonal drivers

- Surface insights for relevant parties

Methodology

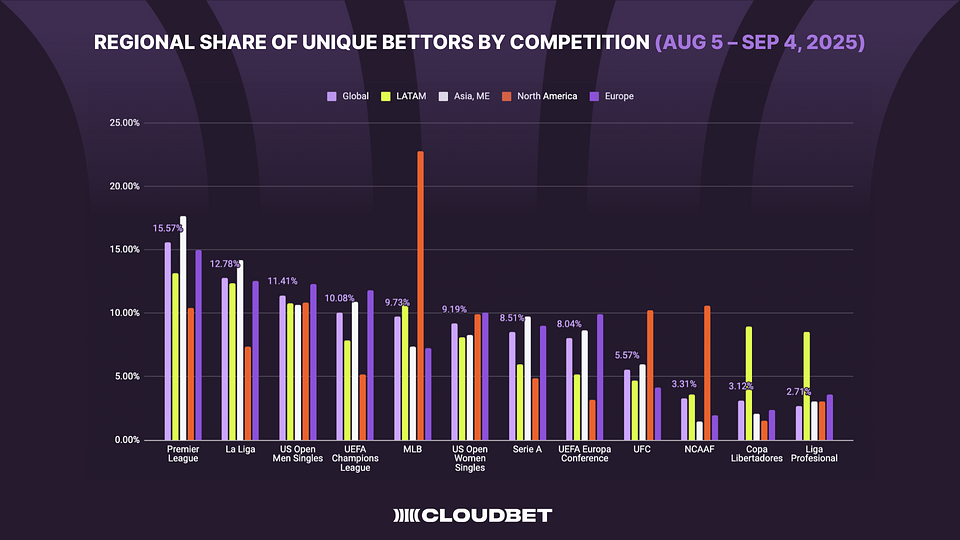

- Period: Aug 5 – Sep 4, 2025 (30 days)

- Metric: (Unique bettors for competition ÷ Total unique bettors across the 12 listed competitions) × 100

- Regions: Global, LATAM, Asia/Middle East, North America, Europe

- Ranking: Competitions ranked by share per region. Bold values highlight activity outside the regional top 5.

- Scope: Focus on high-engagement competitions. Unlisted events are excluded and may skew diversity.

Key findings

Competition | Global | LATAM | Asia, ME | North America | Europe |

Premier League | 15.57% | 13.13% | 17.66% | 10.42% | 14.99% |

La Liga | 12.78% | 12.35% | 14.16% | 7.35% | 12.55% |

US Open Men Singles | 11.41% | 10.77% | 10.66% | 10.83% | 12.31% |

UEFA Champions League | 10.08% | 7.86% | 10.93% | 5.21% | 11.84% |

MLB | 9.73% | 10.89% | 7.38% | 22.78% | 7.28% |

US Open Women Singles | 9.19% | 8.08% | 8.29% | 9.91% | 10.03% |

Copa Libertadores | 3.12% | 8.98% | 2.05% | 1.53% | 2.38% |

Liga Profesional | 2.71% | 8.53% | 3.07% | 3.06% | 3.59% |

Serie A | 8.51% | 5.95% | 9.75% | 4.9% | 9.02% |

UEFA Europa Conference | 8.04% | 5.16% | 8.62% | 3.17% | 9.93% |

NCAAF | 3.31% | 3.59% | 1.45% | 10.62% | 1.95% |

UFC | 5.57% | 4.71% | 5.98% | 10.21% | 4.13% |

Note: Each region highlights its top 5 competitions, except LATAM and Europe where a 6th was included due to closely ranked engagement.

Observations

- Global: Soccer holds 37.86% (Premier League, La Liga, Champions League combined). Tennis spikes at 20.6% thanks to the US Open. MLB sits at 9.73%.

- LATAM: Local affinities drives Copa Libertadores (8.98%) and Liga Profesional (8.53%), alongside MLB’s 10.89%.

- Asia/ME: Serie A (9.75%) leads soccer engagement, while UFC (5.98%) signals growing fight sports appetite.

- North America: MLB towers at 22.78%. NCAAF (10.62%) and UFC (10.21%) show depth. Soccer lags at 10.42%.

- Europe: Soccer balances out — Premier League, La Liga, and UEFA events split share evenly, with tennis (10.03%) staying strong.

Figure 1 note: The chart reflects a combined set of 12 competitions drawn from each region’s top competitions by engagement. It is not a global “top 12,” but rather a mix of favorites that surfaced across Latin America, Asia/Middle East, North America, and Europe.

Analysis and inferences

- Liga Profesional beyond LATAM: Higher-than-expected activity in Europe (3.59%) and Asia/ME (3.07%) suggests diaspora ties, improved broadcasting, and player transfer links. North America’s 3.06% shows weaker spillover, where MLS and domestic sports take precedence.

- Copa Libertadores: At 8.98% in LATAM but just 1.53% in North America, its reach is still limited outside its home region.

- North America: MLB’s 22.78% dominance fits the summer calendar. UFC’s 10.21% reflects fight-night hype, and NCAAF’s 10.62% will only rise as bowl season nears.

- Europe: UEFA Europa Conference (9.93%) stood nearly level with Champions League. With broader access and more competitive teams, it’s gaining meaningful traction.

Limitations

- Subset of competitions: Only the top 12 by engagement are tracked. Niche markets are excluded.

- Regional coverage: Future reports will expand the scope to ensure other regions, where legally permitted, are represented.

- Seasonal bias: Soccer kickoffs and the US Open inflated shares.

- Event timing: Tennis’s 20.6% presence is tournament-specific and won’t hold outside Grand Slams.

- Metric focus: Data shows unique bettor share, not total stakes or handle. Larger wagers on smaller competitions are not reflected.

- Anonymization: With privacy preserved, demographic and absolute growth insights remain out of scope.